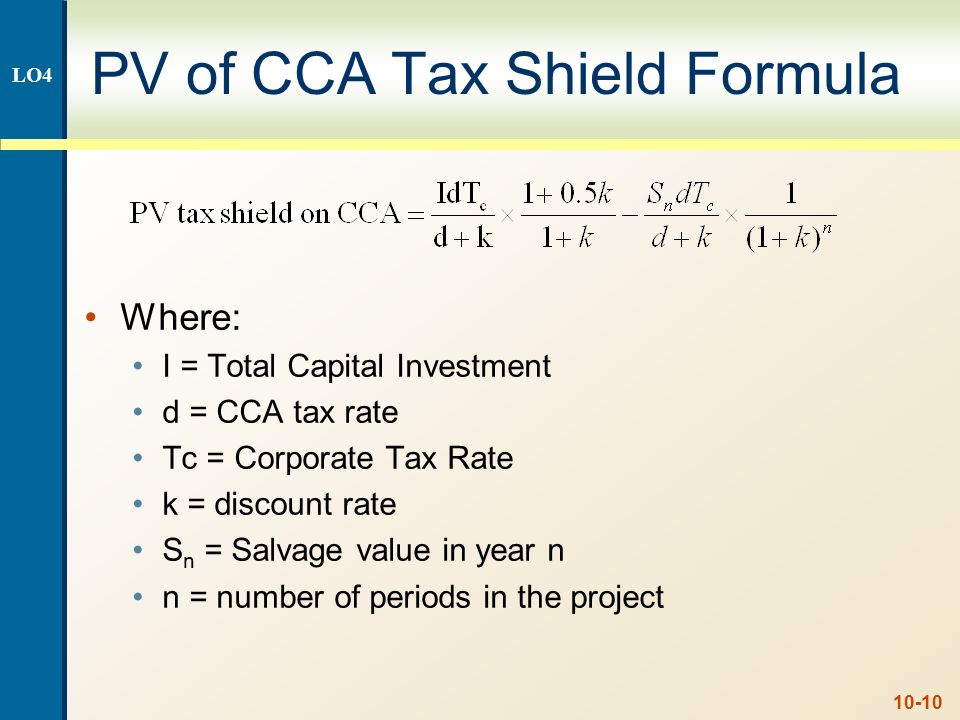

tax shield formula for depreciation

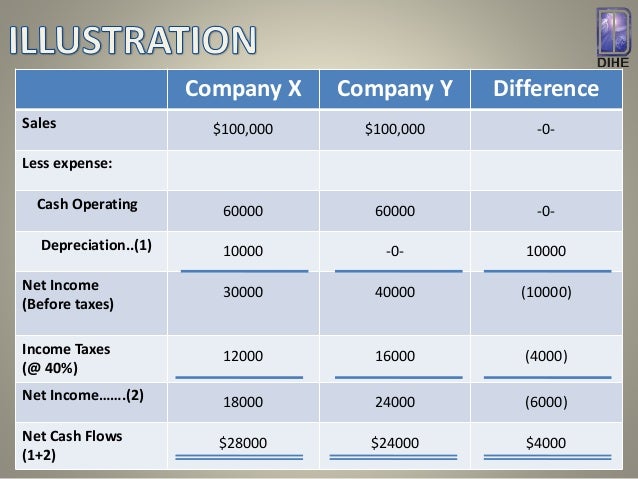

A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a. A tax shield is the use of.

Tax Shields Financial Expenses And Losses Carried Forward

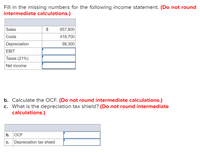

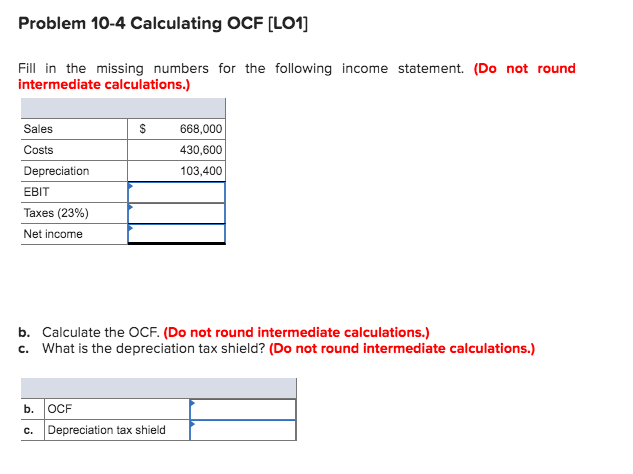

In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense.

. DA is embedded within a companys cost of goods. A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

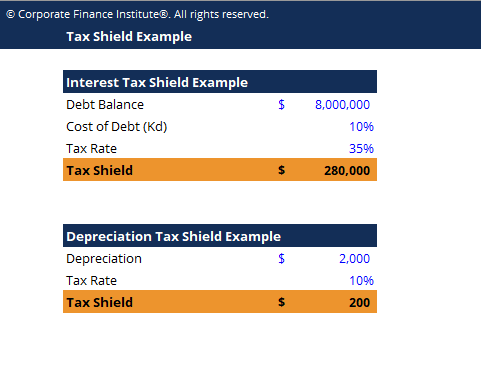

On the other hand if we take the. Depreciation Tax Shield Formula. The depreciation tax shield directly affects income taxes paid ie.

It can be calculated by multiplying the. 2005204219 is your Tax Depreciation Schedule providing the Astute Property Investor a means to create simple accurate and affordable Tax Depreciation. The formula for calculating a depreciation tax shield is easy.

After subtracting the tax expense you arrive at the net operating profit after tax of 630500. To increase cash flows and to further increase the value of a business tax shields are used. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate multiplied by the amount of depreciation.

A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on. When the Depreciation Tax. To see how this formula is used lets.

Shields taxes paid is a tax shield. How to calculate tax shield due to depreciation. The depreciation tax shield is a little like The Matrix but where the Matrix is a place where humans live and the depreciation tax shield is a place where computers live.

Depreciation Tax Shield Formula. Depreciation Tax Shield Finance from. The tax shield computation is represented by the formula above.

The effect of a tax shield can be determined using a formula. Budget Models Learn Accounting Bookkeeping Business Money Management. Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues.

Answered Fill In The Missing Numbers For The Bartleby

Key Concepts And Skills Ppt Download

Solved Problem 10 4 Calculating Ocf L01 Fill In The Chegg Com

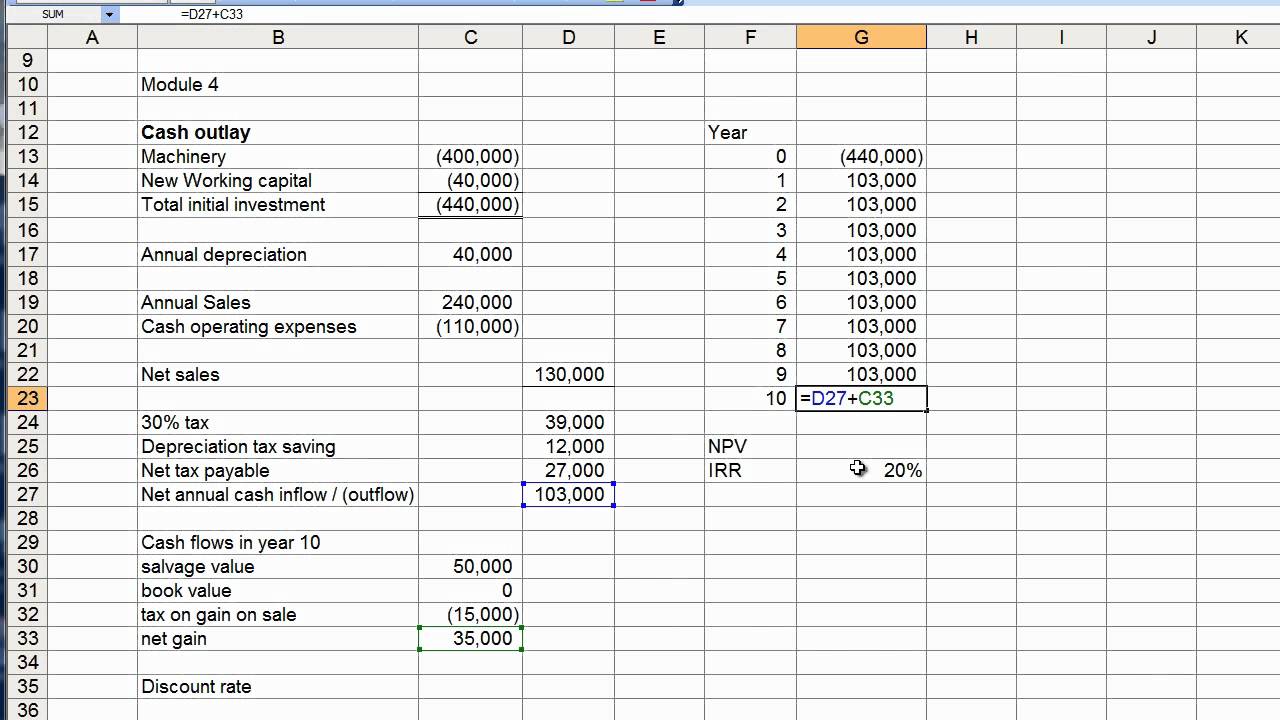

Module 4 Discussion Npv Calculation Youtube

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

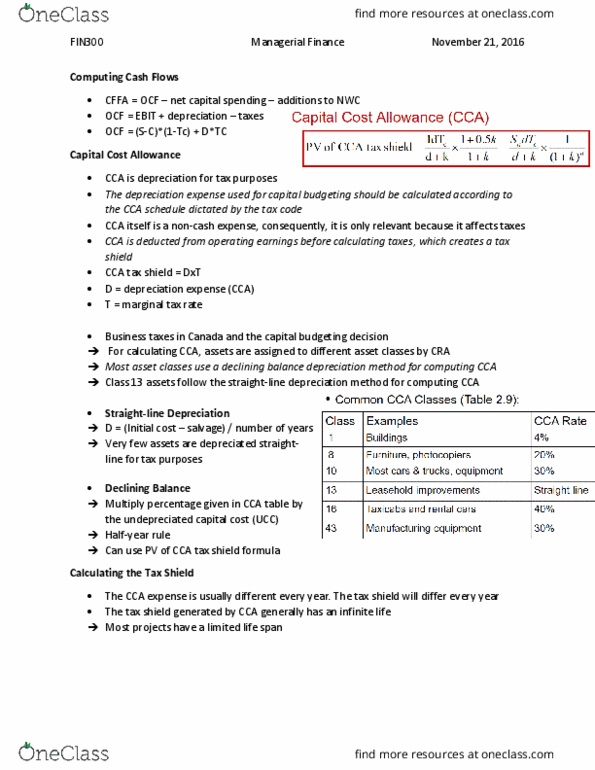

Fin 300 Lecture Notes Winter 2016 Lecture 9 Capital Cost Allowance Tax Rate Tax Shield

Tax Shield Formula Step By Step Calculation With Examples

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

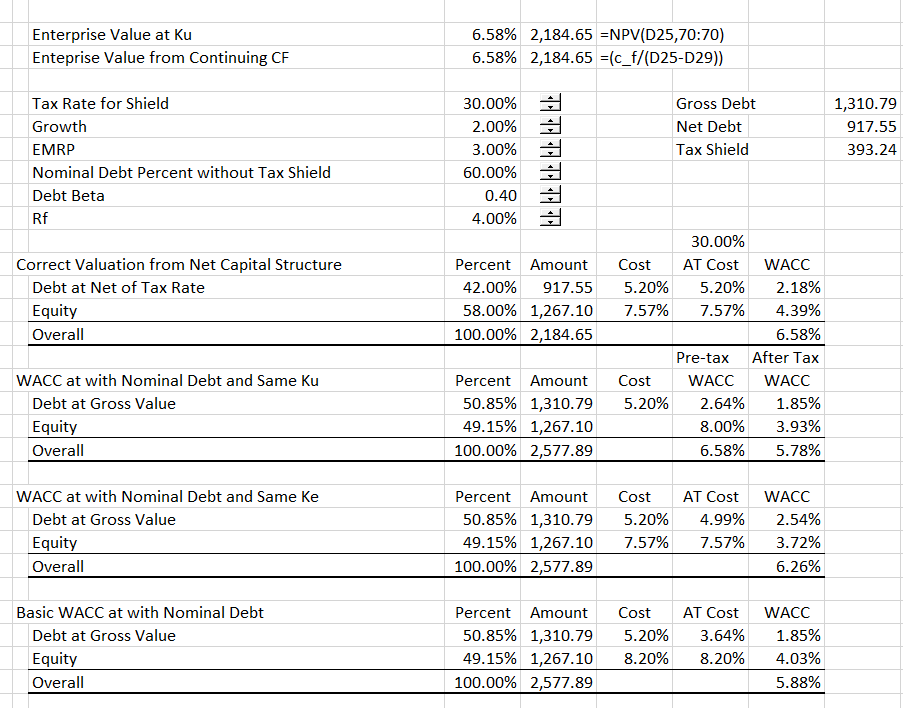

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

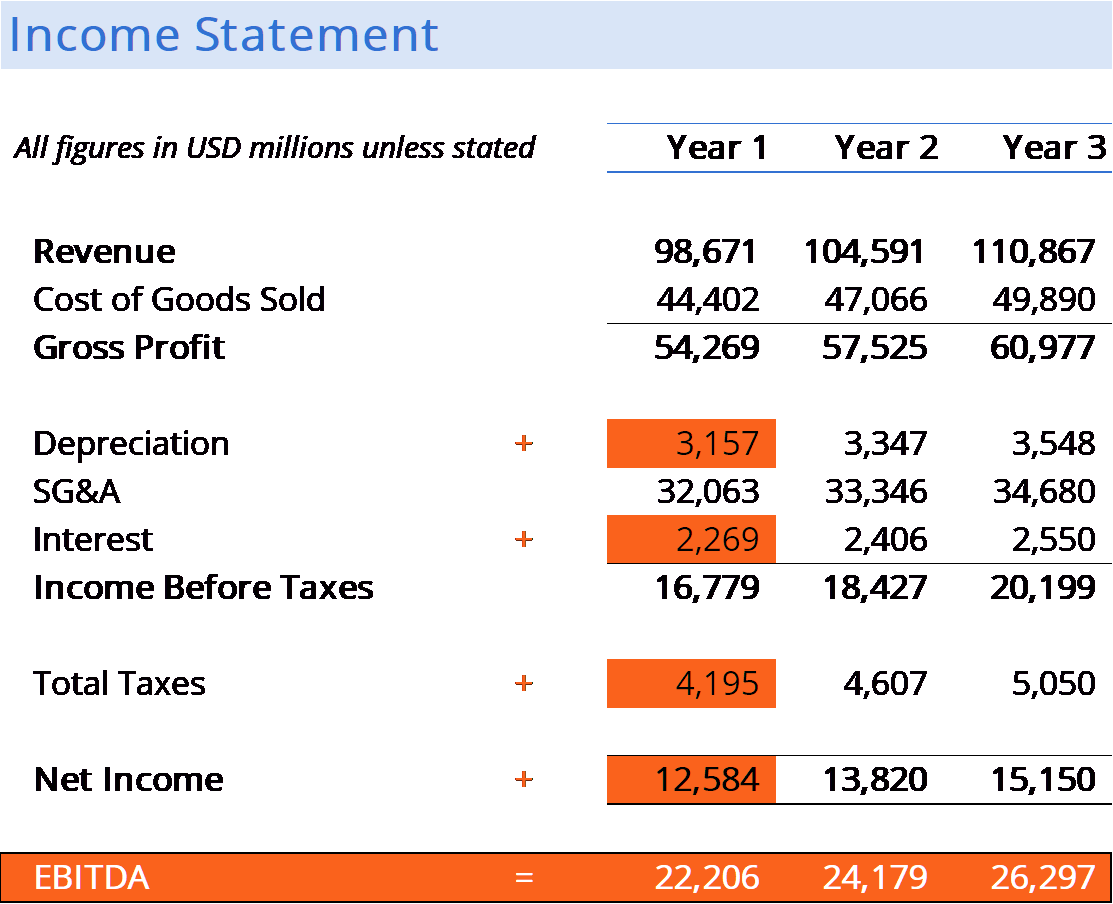

What Is Ebitda Formula Definition And Explanation

Risky Tax Shields And Risky Debt An Exploratory Study

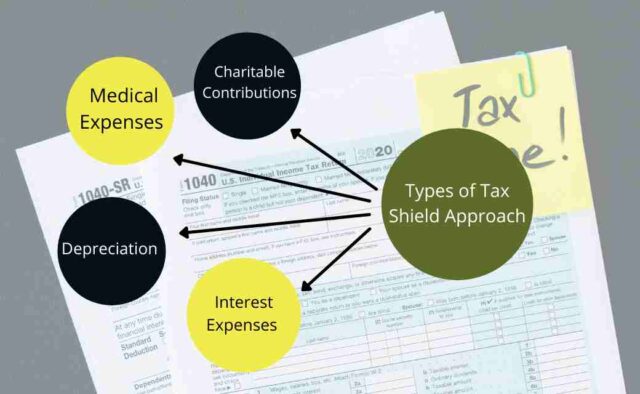

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Interest Tax Shield Formula And Calculator Step By Step

Tax Shield Definition Formula For Calculation And Example

Tax Shield Example Template Download Free Excel Template

To Get The Operating Cash Flow Given The Net Income We Add Back

Tax Shield Formula Examples Interest Depreciation Tax Deductible